New Mountain Finance Stock: Defensive BDC On Sale (NASDAQ:NMFC)

[ad_1]

ipopba/iStock via Getty Photographs

New Mountain Finance (NASDAQ:NMFC) is a company enhancement enterprise with a expanding and very well-managed portfolio, floating exposure that indicates greater portfolio earnings as fascination rates increase, and a minimal non-accrual price.

Furthermore, the company development company handles its dividend payments with internet expenditure profits, and the stock now trades at a 13% low cost to reserve price. The stock is interesting to dividend traders looking for high recurring dividend profits, while NMFC’s reduced valuation relative to book worth leaves home for upside.

Buying A 10% Produce At A Discount

Under the Investment Company Act of 1940, New Mountain Finance is labeled as a Enterprise Advancement Firm. The BDC is managed externally, which indicates it pays a different business for management services. New Mountain Finance principally invests in middle-market place firms with EBITDA of $10 to $200 million.

The majority of New Mountain Finance’s investments are senior secured credit card debt (1st and next lien) in industries with defensive properties, which suggests they have a large likelihood of doing very well even in recessionary environments. New Mountain Finance’s core enterprise is middle sector debt investments, but the corporation also invests in web lease houses and equity.

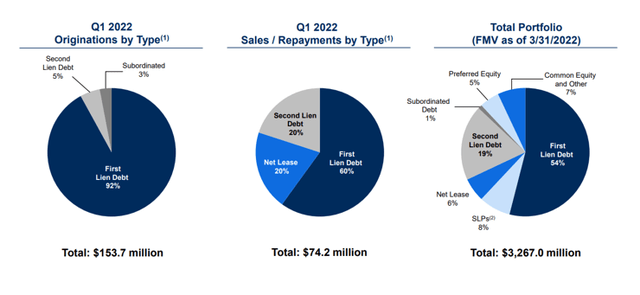

As of March 31, 2022, New Mountain Finance’s portfolio was composed of 54% to start with lien debt and 19% second lien personal debt, with the remainder distribute throughout subordinated credit card debt, fairness, and internet lease investments. In the initial quarter, virtually all new loan originations (92%) had been initially lien financial debt.

The total publicity of New Mountain Finance to secured 1st and 2nd lien financial debt was 73%. As of March 31, 2022, the firm’s full portfolio, which include all personal debt and equity investments, was $3.27 billion.

Portfolio Summary (New Mountain Finance Corp)

Fascination Amount Exposure

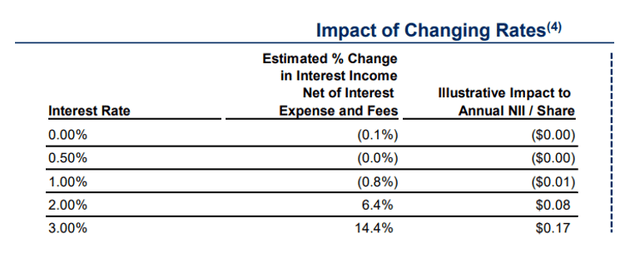

New Mountain Finance has taken care to devote mainly in floating level credit card debt, which guarantees the financial commitment business a loan price reset if the central bank raises desire rates. The central financial institution raised fascination fees by 75 foundation points in June to fight growing inflation, which strike a four-decade significant of 8.6% in May perhaps. An raise in benchmark fascination costs is expected to end result in a important boost in internet interest revenue for the BDC.

Effect Of Altering Rates (New Mountain Finance Corp)

Credit score Effectiveness

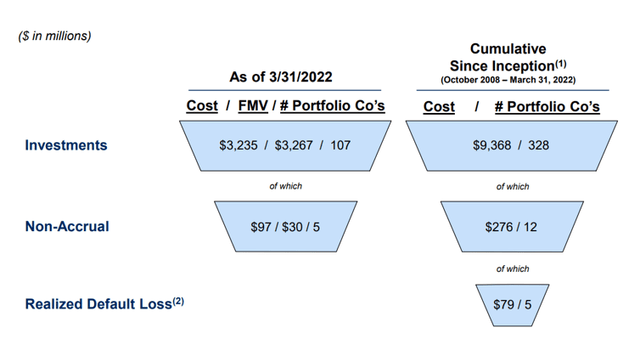

The credit rating performance of New Mountain Finance is great. As of March, 5 of 107 businesses had been non-accrual, representing a $30 million truthful benefit exposure. Considering the fact that the BDC’s complete portfolio was worth $3.27 billion in March, the non-accrual ratio was .9%, and the enterprise has nevertheless to identify a decline on all those investments.

Non-Accrual Ratio (New Mountain Finance Corp)

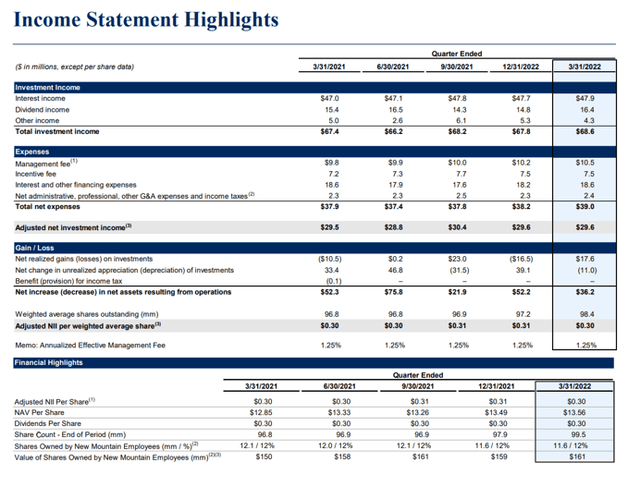

NII Covers $.30 For each Share Quarterly Dividend Fork out-Out

New Mountain Finance’s dividend of $.30 for each share is protected by altered net expenditure income. In the prior year, New Mountain Finance had a spend-out ratio of 98.4%, indicating that it has regularly covered its dividend with the profits produced by its personal loan investments.

Even even though New Mountain Finance at the moment handles its dividend with NII, a deterioration in credit rating quality (personal loan losses) could result in the BDC to under-gain its dividend at some level in the foreseeable future.

Profits Assertion Highlights (New Mountain Finance Corp)

P/B-A number of

On March 31, 2022, New Mountain Finance’s ebook value was $13.56, whilst its inventory cost was $11.84. This suggests that New Mountain Finance’s financial commitment portfolio can be bought at a 13% low cost to reserve benefit.

In latest weeks, BDCs have begun to trade at increased savings to ebook price, owing to fears about mounting desire fees and the probability of a economic downturn in the United States.

Why New Mountain Finance Could See A Reduced Valuation

Credit rating high-quality and guide price developments in enterprise development businesses demonstrate traders no matter if they are dealing with a trusted or untrustworthy BDC. Businesses that report bad credit history good quality and e-book price losses are typically pressured to cut down their dividends. In a downturn, these BDCs should be averted.

The credit score high quality of New Mountain Finance is strong, as calculated by the stage of non-accruals in the portfolio. Credit high-quality deterioration and ebook benefit losses are threat variables for New Mountain Finance.

My Summary

New Mountain Finance is a well-managed and low-cost small business advancement organization to commit in.

At present, the stock value is decreased than the NMFC’s guide worth, implying that the BDC can be bought at a 13% discount to ebook benefit.

Additionally, New Mountain Finance’s all round credit rating good quality appears to be favorable, and the business enterprise growth business covers its dividend payments with net investment cash flow.

[ad_2]

Resource connection